Thought Leadership / Commentary / The Rise and Risks of Private Debt in the Family Office

Why is private debt so important to Family Offices?

Why should Family Offices take steps today to best understand their private debt holdings?

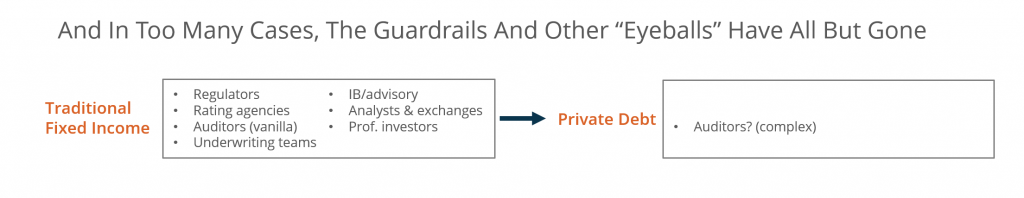

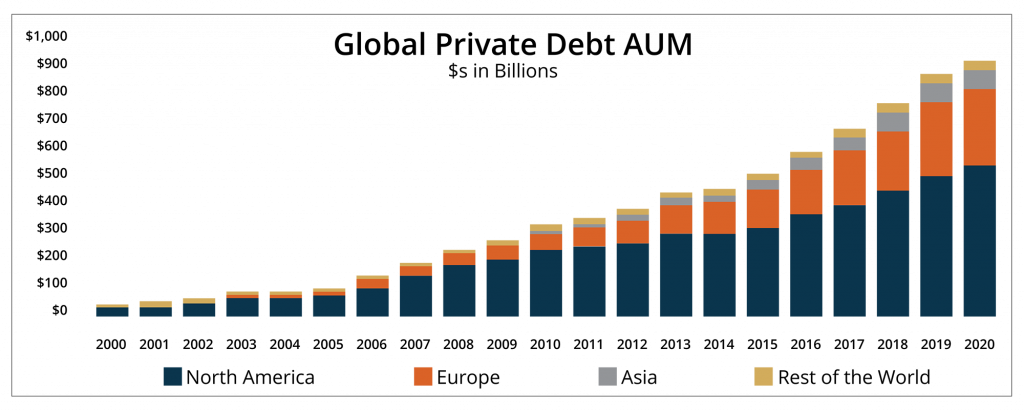

Moody’s rating agency recently reported that the explosive growth and increasing leverage in the private debt industry for this “less-regulated ‘grey zone’ has systemic risks.” Such risks “are rising beyond the spotlight of public investors and regulators.”

Experts from Mirador and V3Limited discuss these issues, providing the answers that family offices need in their webinar: The Rise and Risks of Private Debt in the Family Office, Solutions and Strategies for Management and Reporting.

Mirador Partner and Head of Client Advocacy, Jeremy Langlois and private investment consultants from V3Limited, co-founders Tim Wray and Todd Kellerman take viewers on a journey from the basics of private debt to more comprehensive discussions about its impact on family offices and the potential risks and ramifications if not monitored properly.

Some highlights:

- Understand the importance of the information advantage for investors

- Find out how to use the private debt portfolio to engage your family

- Discover how family offices can properly track, understand and collect on IOUs

- Learn the five questions you need to ask yourself to properly assess your private debt portfolio

With their debt market overview, hear the reasons why this market has become a major asset class for family offices. Learn why risks can be high – or increase without anyone noticing! – and how to identify them.

Today is the day to get full clarity on debt portfolio quality and risk and understand how Mirador reporting and V3Limited monitoring can give you the data, analytics, and insights to make the decisions that add value.

Don’t miss this exceptional discussion.

Watch the complete webinar here – The Rise and Risks of Private Debt in the Family Office.

Posted by Mirador

Posted by Mirador