Thought Leadership / Commentary / Tax Loss Harvesting for Private Investments

Part 1: The “Conservative GP” Factor

Introduction

Investors know the real benefit from tax loss harvesting both in concept and in the numbers. In the public markets, it’s a smart piece of an investment strategy and its execution is straightforward, typically being completed at the end of the year, and often done as a stand-alone process in fairly short order.

However, private investing (which includes private equity (PE), leveraged buyout (LBO), venture capital (VC), private real estate, private credit/debt, etc.) is nothing like the public markets, and that includes the tax loss harvesting process. Tax loss harvesting in private investments, if done right, is a year-round, complex process that should be integrated into risk and private portfolio management.

As we are nearing year-end, and investors are likely finalizing their tax loss harvesting process, we begin this multi-part series with the one thing investors should do before they pull the trigger on any harvesting in their private portfolios – determine how conservative your GP general partner or management team (together the GP) is valuing your private fund or private direct investments – otherwise known as the “Conservative GP” Factor. Part 1 is the first installation in the Tax Loss Harvesting for Private Investments series.

The Tax Loss Harvesting for Private Investments series will focus on three key areas:

1. Understanding future realized value today: The current reported value may be materially different to the value you ultimately realize (present value or otherwise).

2. It’s not a stand-alone strategy: Tax loss harvesting must be incorporated into your portfolio construction/allocation, risk management strategy, and trust and estate planning: It’s a year-round process that takes time to execute and play out.

3. The most important problem to solve: The biggest problem in private investing is “getting stuck.” Whether a loss, just getting back your invested capital, or even a gain, the multi-year-to-“decade+” wait for realizations/distributions is the single greatest impairment to private investment returns.

The Conservative GP Factor – A Case Study

To emphasize the importance of knowing if a GP is a Conservative GP Factor-type, we will share a real-world anecdote – although there are countless more – with a numbers comparison to show the importance for an investor to ask the right questions and have the right information.

The Situation

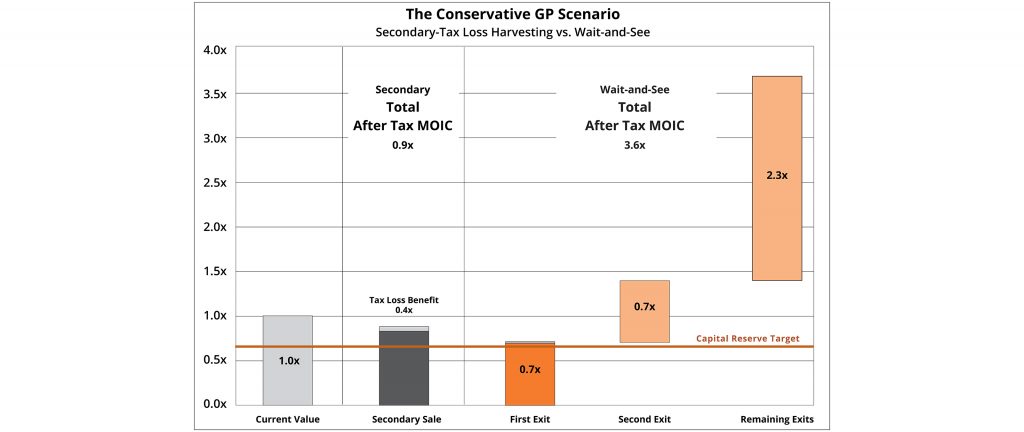

A family office (“FO”) had a capital requirement for another need coming up in just over 12 months and was looking to sell a PE fund interest on the secondary market to establish a reserve for that requirement. The PE fund had six investments remaining in the portfolio and those six investments were all valued at par (invested capital amount). The FO had received pricing on selling their entire position at a 15% discount to par, an amount that would have been just in excess of the needed reserve. The quoted price would have provided a small tax loss harvesting benefit.

The Approach & Recommendation

We were engaged at this late stage to analyze the offer for the FO. The fund GP provided us certain financial information on the portfolio companies, and we had a few follow-up Q&A calls with the GP. There were two key takeaways from this process: (1) the GP had a preference/perspective that investments were not marked up unless it was absolutely necessary, and (2) the two largest (in total invested capital) portfolio companies were currently engaged in a sales process that appeared to be headed toward transactions at significant values.

Completing our analysis in short order (as was required) our recommendation was to not sell the PE fund position for at least the next six months (in essence, for the FO to take a wait-and-see approach).

The Outcome

Within three months of this recommendation, the largest portfolio company was sold and closed for a net >3x multiple on invested capital (MOIC). This amount alone was (on an after-tax basis) in excess of the amount required for the FO’s reserve. For clarity, the FO still retained their full interest in the PE fund. Then, five months from our wait-and-see recommendation, the other large portfolio company was sold for a >5x MOIC, again an amount (on an after-tax basis) that itself was in excess of the amount required to fund the needed reserve.

In the end, by not selling their PE fund interests, the FO was not only able to fund the reserve well in advance but realized >4x the amount versus selling their position on an after-tax basis. Simply put, the value of the tax loss harvesting benefit and the proceeds from a secondary market sale were materially less than, if not dwarfed by, the outsized after-tax returns that were generated in both short order and in total by the end of the fund. See chart below.

Our Guidance

Before completing your tax loss harvesting process and selling lower or depressed value private investments for the tax benefit, pick up the phone and call your GP/Manager to get a clear picture on the following:

- What is the current and projected market valuation multiple for the top holdings?

- What is the current and near-term projected financial performance for the top holdings?

- What is the outlook for a sale/exit date for the top holdings?

A couple of important tips:

- It is important to speak (i.e., not email) with senior investment members of the GP when asking these questions.

– First, what a GP will discuss in conversation can be materially more helpful than what they will put in writing.

– Second, the senior investment principals have a much clearer understanding of what is happening/will happen with portfolio companies. Junior or investor relations professionals may not have a clear or access to the complete picture.

- Understand that a GP is likely not going to come right out and give you all of the direct answers to your questions.

– There are a number of factors that require them to keep information confidential. But by asking the right general or market questions combined with the right provided information, you can connect the dots and have a much clearer picture of the situation, relevant values, and exit timing.

In Closing

There are not a lot of very conservative GPs out there, but there are enough to warrant this advice. More importantly, in today’s current environment of big multiple expansion movements and big exits, you may be holding a private investment that is on the verge of a/some major transaction(s). Not all of these situations are of the magnitude of the scenario provided above, but you may have a situation where some significant value and realizations are about to be achieved. The right GP call could give you the information you need to drive the most value for both your total portfolio and your tax loss harvesting efforts.

Our series will continue with a focus on the importance of year-round tax loss harvesting attention and planning in private investments.

Good luck and happy harvesting!

Posted by Mirador

Posted by Mirador