Thought Leadership / Commentary / The K-Recovery In The Private Markets

The ‘K’ in Private Investment Portfolios1

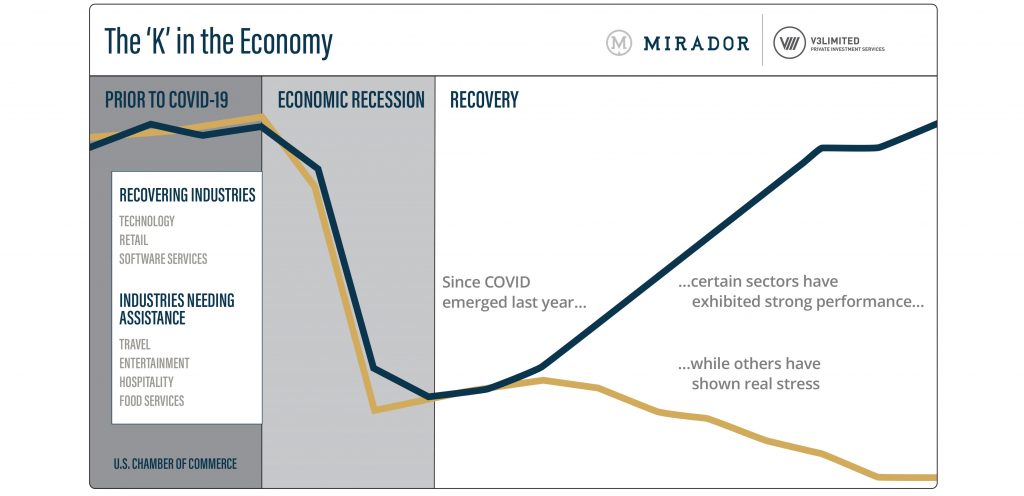

In the context of investor capital, a K-recovery is when market and economic forces drive certain investments to outperform expectations (the upper ‘arm’ of the K) and other investments to significantly underperform expectations (the lower ‘arm’ of the K).

We will likely continue to see strong positive and strong negative forces that will push and pull various private investments at different times between these K trajectories over the next few years.

As part of their partnership, Mirador and V3Limited are co-authoring reports to bring additional private market value to their clients and the industry. In this report, Mirador gives context to K-recovery dynamics with V3Limited providing their private investment perspective in the report’s K Recovery Insights.

K Recovery Insight

“Having visibility into how each private investment is doing, and as importantly, having a clear perspective as to when each may fall on one of the K arms will clearly help investors make better decisions and drive better outcomes.”

Expect the Unexpected

Since the onset of COVID, the public markets experienced sharp declines with certain sectors/companies having a robust recovery, while others remained in problematic/troubled condition.

Expect a similar if not greater level of dispersion in private market outcomes in the coming years.

K Recovery Insights

“Expect performance surprises. After the 2008 global financial crisis, private investment underperformance, for the most part, did not surface until 2010 and later years. Private investments are already opaque and there are ‘tools’ that general partners and management teams can use to delay the signs of trouble (i.e., service debt with subscription lines and dry powder). These steps can allow time, often rightly so, to address challenges and get investments back on track. But problems will still unfold over time, will be harder to identify, and then will get ‘dropped into investors’ laps.'”

“Expect unpredictable cashflow. While the gap between a strong and poor performing public equity manager is typically less than 500 basis points (5%) in annual return, the dispersion in private investments can be 4,000 basis points (that’s right… 40% per year). This dispersion may expand even farther, which means for the lower ‘K’ arm potentially even greater loss of invested capital compounded by multiple years waiting for distributions (think 5 or even 10 more years). Recent industry data and reports show that this “K spreading” – both the up/good and the down/bad – in returns and delayed distributions has already begun in PE.”

Improve Visibility and Decision-Making

Upside positive indicators and downside red flags are difficult to spot, especially early enough to be able to properly respond and act.

We recommend an iterative analysis focused on 3 critical areas:

1 Cashflow

- Have or will distributions slow or stop?

- Have or will capital calls increase from plan?

- Are any changes to exit expectations being communicated?

2 Valuation

- Do valuations look stagnant?

- Are they in-line with industry peers?

- Has the valuation methodology changed and why?

3 Progress

- Is each investment making progress towards its stated goal?

- If not, what is the expected progress going forward?

- Is management positioned and taking the right steps to drive results?

K Recovery Insights

An accurate and objective perspective on cash flow, valuation and progress can help investors avoid getting “stuck” for years to come.

“In Private Markets, dramatic dispersion also occurs with distribution timing. It is not only what you get back but when you get it.“

“As opportunities and challenges arise, knowing the outlook and having capital available will be key to long-term outperformance.“

“Cash flow forecasting is key. Not having it or relying on “general forecast” models (i.e., using standard J-curves) can be very problematic and woefully inaccurate. Know exactly what investments will drive large distributions and when, and what investments will struggle so action can be taken.“

space goes here

Schedule a Consultation with our Experts

The Mirador and V3 partnership was built to deliver the details needed for investors and fiduciaries to make informed decisions and realize more value.

Mirador allows you to focus on the output of your performance reporting system instead of the mechanics of producing timely and accurate information.

V3 strengthens decision-making with objective insights and hands-on principal investment expertise to problem-solve and ensure private investments work.

1. Private Investment/Market and private equity (PE) investments include all illiquid private funds, fund of funds, and direct structured investments across asset classes including buyout, venture, real estate and credit.

V3 Disclosures:

Statements of future expectations and other forward-looking statements are intended for illustrative purposes only. Actual results, performance or events may differ materially from those expressed or implied. Past performance is not an indication of future results. There are inherent risks, both known and unforeseen, involved with investing, including loss of principal. Information, commentary and the related analysis included herein should not be deemed as advice nor as a recommendation.

© Copyright 2021 Mirador LLC & V3Limited LLC

Posted by Mirador

Posted by Mirador