Thought Leadership / Commentary / Direct Investing for Family Offices Part 2: Opportunities & Risks in Today’s Market

Factoring Economic Headwinds Into Your Direct Investing Strategy

If economic conditions weaken during the next 18 months…

How will your direct investment portfolio respond?

• Will your operating companies and real estate holdings stagnate or grow?

• Will your thesis, search criteria and deal flow sources properly consider the opportunities and risks?

Perspective: The Canary in the Coal Mine

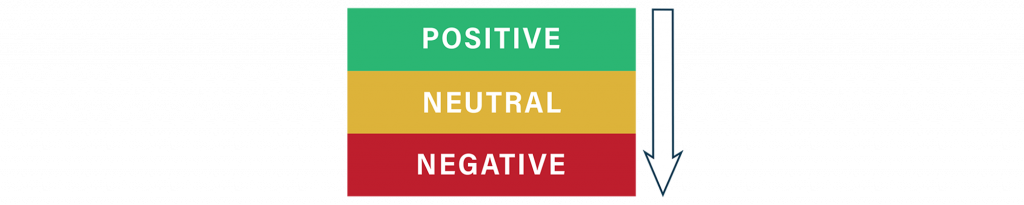

How well-run, well-capitalized and recession proof is your direct investment portfolio and stategy? Are you prepared for neutral-to-negative economic conditions?

Interest Rates: (higher) tight monetary policy could negatively impact profitability and cashflow.

Interest Rates: (higher) tight monetary policy could negatively impact profitability and cashflow.

Inflation: (higher) increased labor/material costs and limited pricing power vs. historical levels.

Inflation: (higher) increased labor/material costs and limited pricing power vs. historical levels.

Sentiment: (subdued) lower business and consumer measures vs. historic norms could slow spending.

Sentiment: (subdued) lower business and consumer measures vs. historic norms could slow spending.

Liquidity: (restricted) inability to access capital could become prohibitive and extend holding periods.

Liquidity: (restricted) inability to access capital could become prohibitive and extend holding periods.

Fiscal policy: (uncertain) potential tax policy and regulatory changes from recent election cycle.

Fiscal policy: (uncertain) potential tax policy and regulatory changes from recent election cycle.

As a long-term strategic investor in operating businesses and real estate, an economic slowdown creates a unique opportunity for you to collaborate and problem-solve with your portfolio companies, management teams and deal sources.

Identifying and analyzing specific factors that positively or negatively impact your existing and potential debt and/or equity investments in venture capital, established operating businesses and real estate (commercial, industrial, retail and residential properties) will ensure you have a proactive plan and be positioned to create long-term value for your family.

Ways to Protect Direct Investment Capital During an Economic Slowdown

As a steward of family capital (investor) and/or fiduciary (board member) of a direct investment portfolio, here are five areas on which to focus to help you meet your direct investment goals.

1. Transparency

Do you have a dashboard that tracks key performance indicators?

• Revenue & profitability projections

• Debt load, maturities and covenants

• Management compensation

• Operational/employee risks & opportunities

• Corporate development initiatives

• Customer and tenant (real estate) health

2. Alignment

Are the proper incentives in place to ensure stakeholders are aligned?

• Are the milestones used to compensate management still applicable?

• What conflicts of interest exist or will exist during an economic slowdown?

• Do investment terms or rights warrant review and/or change?

3. Management

Does leadership have the experience needed to anticipate and address trouble?

• Do your management teams have what it takes to get through a recession?

• Have they done it before? What’s their record?

• Have they communicated their updated plan?

4. Cash

Does each business have a cash reserve on-hand to weather the storm?

• Do you have a clear picture of how the sources, uses and cost of capital are changing?

• What contingency plans are in place to access capital from banks, investors or other sources?

• Are weekly, monthly and quarterly cash flow reports used by management?

5. Action

Does management and the board have a bias toward action?

• Whether you have a vote, you always have a voice as an investor.

• Consistently communicate positive (and negative) news with family members, where applicable.

• If you do not have the expertise on-hand to address specific issues, act and engage.

A New Approach – Optimize Your Direct Investing Program

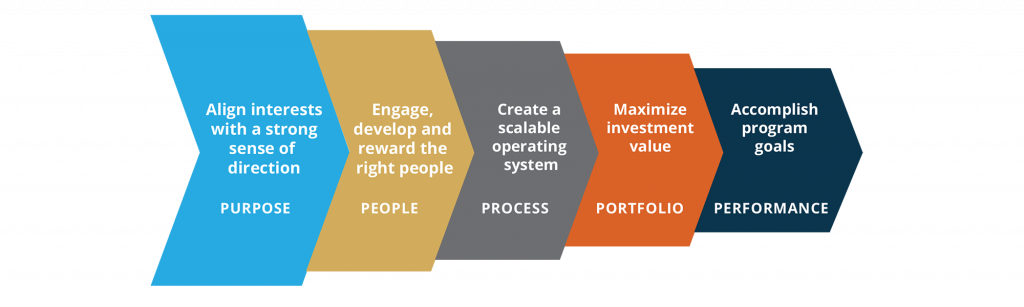

To harness a family’s unique characteristics and optimize its direct investing approach we created the V3 5-Part Direct Investment Program Framework. An integrated approach that includes the important steps of the traditional private investing lifecycle through the lenses of a family office.

This is Part 2 of a 3-Part series. Watch this space for Part 3 – Direct Investing for Family Offices – Optimizing Across Generations.

Our Road Map Service includes a simple set of interviews and direct investment portfolio analyses. At the completion of what is approximately a 45-day process you receive a customized Road Map Report which identifies opportunities for you to implement 20 key actions to strengthen your Direct Investment Program.

Schedule a call with an expert to start creating your Direct Investment Program Road Map.

Contact us at either investments@v3-limited.com or info@mirador.com.

Posted by Mirador

Posted by Mirador